Financial markets are not isolated from the world around them. Instead, they are intricately linked to global events, reacting and responding to a multitude of factors, from geopolitical tensions and economic indicators to natural disasters and health crises. In this article, we will explore the dynamic relationship between global events and stock market volatility.

1. The Complex Nature of Stock Market Volatility

a. Defining Volatility

Stock market volatility refers to the degree of variation in the prices of financial assets over time. It is a measure of market instability and can impact investor confidence.

b. Volatility Index (VIX)

The VIX, often referred to as the “fear gauge,” is a widely used index that quantifies market volatility. It tracks the expected volatility of the S&P 500 Index over the next 30 days.

2. Geopolitical Events and Market Jitters

a. Trade Wars

Geopolitical tensions, such as trade disputes between major economies, can significantly influence stock markets. Tariffs, trade restrictions, and retaliatory measures can lead to uncertainty and market fluctuations.

b. Political Instability

Political events, including elections, regime changes, and government crises, can have a profound impact on markets. Investor confidence may waver as uncertainty about policies and leadership arises.

3. Economic Indicators and Investor Sentiment

a. Unemployment Rates

Economic indicators like unemployment rates can affect market sentiment. High unemployment may signal economic challenges and lead to market sell-offs.

b. GDP Growth

The growth rate of a country’s Gross Domestic Product (GDP) is a key economic indicator. Negative GDP growth or recessionary signals can trigger market downturns.

4. Natural Disasters and Climate Change

a. Physical and Economic Impact

Natural disasters, such as hurricanes, earthquakes, and wildfires, can cause extensive damage to infrastructure and economies. Insurance claims and reconstruction efforts can impact financial markets.

b. Climate Change Concerns

Growing concerns about climate change and its long-term economic effects have led to increased attention from investors. Companies’ environmental sustainability practices can influence their stock prices.

5. Health Crises and Market Turmoil

Pharmaceuticals and Biotech Stocks

Health crises often lead to increased investment in pharmaceutical and biotech companies. These sectors can experience significant market movements as they work to develop treatments and vaccines.

6. Technological Advancements and Innovation

a. Tech Sector Volatility

The technology sector is known for its rapid innovation and growth, but it can also be prone to volatility. Market reactions to product launches, regulatory changes, and cyber security breaches can be swift.

b. Cryptocurrencies

The emergence of cryptocurrencies has added a new layer of complexity to financial markets. The prices of digital assets like Bitcoin can be highly volatile and influenced by global events.

7. Investor Behaviour and Market Psychology

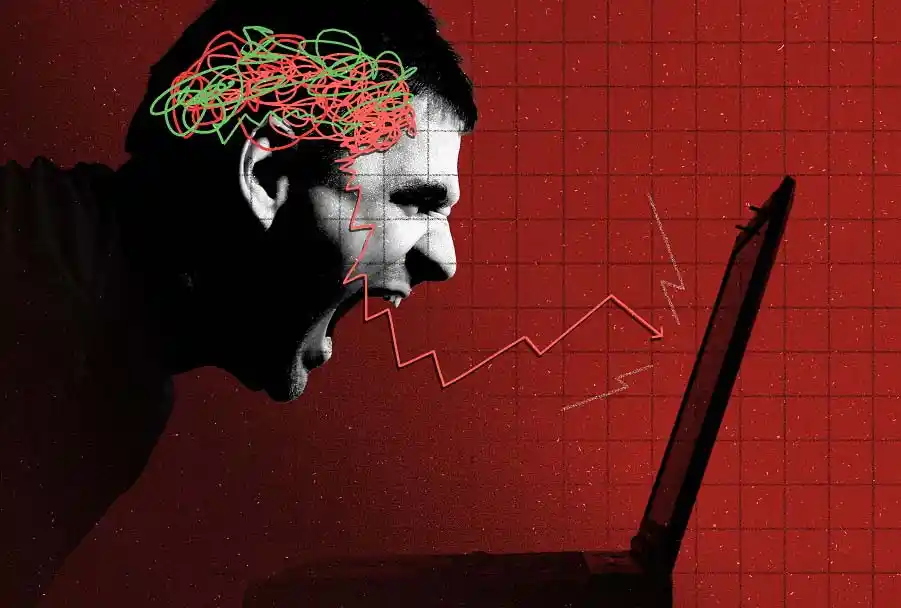

a. Fear and Greed

Investor sentiment plays a crucial role in market volatility. Fear-driven selling can lead to market downturns, while exuberance can drive prices to unsustainable levels.

b. Herd Mentality

Investors often follow the herd, buying or selling based on the actions of others. This behaviour can amplify market movements during times of uncertainty.

8. Risk Mitigation and Investment Strategies

a. Diversification

Diversifying investments across different asset classes can help reduce risk. A well-balanced portfolio may be more resilient to market volatility.

b. Risk Management

Investors can use risk management tools, such as stop-loss orders and hedging strategies, to protect their investments during turbulent times.

Navigating the Volatility

Stock market volatility is a natural part of investing, driven by a complex interplay of global events, investor sentiment, and economic factors. While it can present challenges, it also offers opportunities for those who understand its dynamics. Successful investors often adopt a long-term perspective, maintain diversified portfolios, and stay informed about global events that may impact their investments. By doing so, they can navigate the seas of market volatility and potentially capitalise on opportunities that arise during uncertain times.